Frequently Asked Questions

View commonly asked questions about Orchid Insurance

How do I request policy documents?

Agents may access policy documents through our policy administration systems or visit the Agent Servicing Portal to submit a case.

Click this link to create a case

If you are a policyholder, please contact your agent for assistance.

How do I cancel a policy?

Agents should submit cancellation requests through the Agent Servicing Portal.

When submitting the case, upload a signed cancellation request (LPR), along with any additional supporting documentation. Supporting documentation may include a HUD statement if the home has been sold, a copy of replacement coverage, or a certificate of occupancy if the home is no longer under construction.

Where is my policy?

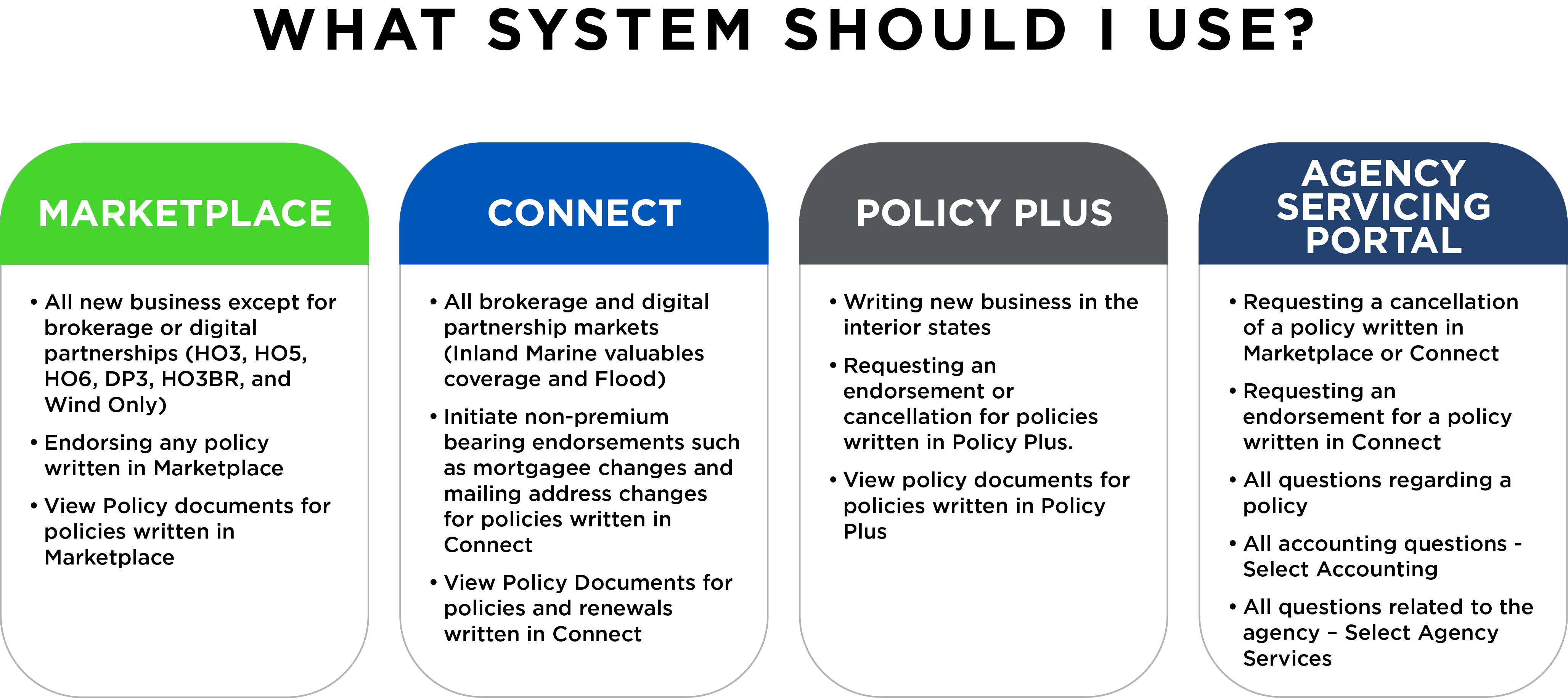

Since Orchid utilizes multiple platforms, we encourage agents to visit their Agent Servicing Portal to identify which system they should access for any individual policy.

If you know a policy was bound and are awaiting issuance documents, please note it may take up to 36 hours to process bind requests. However, some markets may take up to one week for issuance. Agents can review status of policies via the Agent Servicing Portal.

If you are a policyholder, please contact your agent for assistance.

How do I make an endorsement?

Agents are required to submit an endorsement request through the Salesforce Agent portal and follow the standard instructions to create a case for the Service Operations team to complete your endorsement request. All other parties or Agents with no Salesforce Agent portal access should call us at 1-866-370-6505.

When submitting a case, include the insured’s name, policy number, the effective date of the change requested, and the changes you would like made.

New Marketplace policies allow agents to create endorsements. Some may require underwriting review prior to issuance. You will be notified of the status on your dashboard.

Payments

How do I make a payment?

We accept payment via credit card, ACH, or check.

For credit card or ACH payments, please click here. For credit card payments (MasterCard, VISA, Discover, American Express), an additional processing fee will apply.

For check payments, please include your policy number, make payable to Orchid Underwriters and mail to:

Standard Payment Address

Orchid Underwriters

PO Box 956397

St. Louis, MO 63195-6397

Overnight Payment Address

Orchid Underwriters

SL-MO-R1LB #956397

3180 Rider Trail S.

Earth City, MO 63045

Can I make monthly payments?

Orchid does not accept monthly payments. However, your agent may have premium financing options available to you.

When will I receive my refund?

Refunds are issued within 2-4 weeks of the transaction being processed. If it has been more than 4 weeks and a refund has not been issued, plus submit a case in Agent Service Portal or contact your agent.

Agency Maintenance

How can I get my agency appointed with Orchid?

Click here to fill out our Appointment form. An Orchid representative will respond within 2 business days.

How do I add a user?

The agency administrator should enter a case into the agent servicing portal requesting the addition on the new user. The administrator will then have the ability to adjust the users settings.

Claims

How do I report a claim?

To report a claim, please contact your agent. To file a claim, please click here to locate your carrier’s adjusting firm. If you need assistance, please contact us at 866-370-6505. Once your claim is filed, the adjuster should contact you within 24 hours.

When will the adjuster reach out to me?

After you file the claim, the adjuster will reach out within 24 hours. It is the insured’s responsibility to take the necessary steps that are required to negate any further damages and secure the property until an adjuster can be on site.

Marketplace

What type of coverage is available in Marketplace?

You can quote HO3, HO5, HO6, DP3, builder’s risk, wind only, and x-wind in Marketplace.

I am having trouble logging back in to Marketplace, what do I do?

Be sure you are using this link; marketplace.orchidinsurance.com. If you are still unable to login, please select “Forgot password”.

Will this new login access all systems with Orchid?

The new login for Marketplace will also be your login for the Agent Service Portal. Your logins for Connect and Policy Plus remain the same.

Who should we reach out to for assistance as we learn to use the new system?

Your Agency Development Manager is a great resource. They are listed under State Guidelines.

When logging in, can the verification codes be sent by text message?

Verification codes can only be sent to email addresses for now.

Will each user have their own login credentials to Marketplace?

Yes, all users must have individual credentials based on their role as Agent or CSR. These roles may be maintained by the Agency Principal in the Agent Servicing Portal. Group or shared email addresses are not eligible for credentials.

If I have an active quote in Connect, will I have to create a new quote in Marketplace?

Any quotes that are pending bind in Connect can still be bound. They do not need to be resubmitted in Marketplace.

Where do I go to see a policy status?

Your Dashboard in Marketplace will allow you to search for a quote or policy where the policy status is displayed.

Remember: you must call an Underwriter to review any new business submissions requiring underwriting review. Call us at 866-370-6505.

How can I get an additional quote?

From My Dashboard search for the submission number. Select the desired result. On the top line select the quote number. Scroll to the down and select “Go To Quote”. Then select “Return To Available Markets”. Please be sure to update the Replacement Cost Estimator and the risk information on the new quote.

Why am I able to change the commission amount?

In some cases, adjusting the commission may bring the premium into the target range you are seeking.

What happens if I select the quote and proceed to carrier, but then, it does not qualify? Am I able to go back in to a select a different company or do I have to reenter the quote into the system and select a different company?

Some rules are carrier-specific. If you receive a declination for a specific carrier, you are welcome to contact an underwriter about an exception. You may also return to Available Markets and choose another carrier. You will have to complete a new application, however.

At what TIV amount will a quote be automatically referred to underwriting?

Marketplace will automatically refer quotes with a TIV of $2 million or more to underwriting.

Why am I am not able to validate the mailing address on this submission?

When entering a mailing address, consider that some remote, rural, and island addresses receive mail at a PO Box. Ensure that you have the correct mailing address.

How far in advance can I quote?

You may quote up to 30 days in advance. Quotes are valid for 30 days. If a change is made to the quote, it will be good for 30 days from the date of change.

Is an alarm certificate required to select bind?

No, you can quote and select bind without uploading the alarm certificate.

Where can I upload the Wind Mit and Four Point Documents?

From your dashboard, select the quote number, scroll down to the “documents attached for underwriter review” section, and select the “Upload Document +”button to upload your documents. Uploading documents to this section will trigger a review by underwriting and you will have to call in to release.

How long will it take for an underwriter to review the uploaded documents?

Once these documents are uploaded, and “Bind” is selected the quote will refer, call underwriting to clear the referral.

How do I change the effective date of a policy?

From your dashboard, select the quote number to open it and change the effective date. Please note that if you do change the effective date, it will generate a new quote number. If you already secured eSignatures on the old quote, you would have to resend new eSignatures for the updated effective date.

Is there a way to avoid the eSignature requirement?

Not at this time, eSignature is required for all applications.

Why is Docusign not being accepted?

Docusign is not compatible with Marketplace.

If an eSignature email is missed can I resend it?

Yes you can. From your dashboard, locate the quote, open it, and select “Send eSignatures”.

Am I able to obtain a quote from Connect and Marketplace?

Yes, but not for the same carrier. Connect will still be active for any brokerage markets, such as Beazley.

Do we have to use the RCE in Marketplace if we already have one?

You will need to complete the RCE in Marketplace to establish Coverage A.

How do I print and share the quote?

From the quote details screen, scroll to the bottom of the page to the section labeled “Documents.” Select the blue link for the desired document. You will be able to download, print or email the desired document.

We are excited to offer you premium indications ahead of full application submissions. However, please be aware that premiums may be subject to change after application submission, especially if there is claim history or an underwriting referral.

Is there a Loss Assessment for condos?

Yes. Most of our carriers offer increased limits as well.

What do I do if my application is referred or there are no open markets?

If the Marketplace platform shows no markets, we recommend you check all data inputs (especially on the Property Details page) first. Ensure the home characteristics are accurate. If you still find no markets, we recommend you try our brokerage markets by inputting a Connect submission. You may call our underwriters should you feel the risk is a fit for our carriers.

What is the difference between the status of Bound and Issued?

A “bound” status indicates a formal offer of insurance has been made, however no payment has been made. A binder is available to agents via their dashboard and mailed to the named parties on the requested policy. Once we receive the payment, the status will automatically update to “issued” and the policy package will be available to agents via their dashboard and mailed to the named parties on the policy.

Will MEP (Minimum Earned Premium) be charged on a policy in bind status?

Minimum earned premiums do not apply to bound policies since the policy has not been paid and therefore coverage is not yet in force.

What if I do not have the name, address, and loan number for the mortgagee?

Once policies are bound, they are not able to be endorsed. Once payment is made and the policy is issued, endorsements are available to you. We encourage you to obtain accurate mortgagee information prior to finalizing your applications.

If the mortgage company does not pay what happens to the policy, will MEP be charged?

MEP is not applied on bound policies. If the mortgage company or policyholder does not pay the premium, we will rescind the binder through an Offer Withdrawn letter. Since no coverage would have been in force, no MEP applies.

Does Orchid accept payment plans?

There are no payment plans with Orchid like today, but you can use premium finance of your own if you wish. All premiums paid through a finance company are considered insured bill and due 15 days of the effective date.

If the Agency collects the money can we submit the net amount or only the gross amount?

If the agent collects the premium they must submit the full amount to Orchid. Failure to send the full payment would result in the policy being cancelled.

Will I be notified of a payment on a policy?

When a policy changes from a status of “Pending Payment” to “Issued”, this means we received the payment. You will receive an automated notification via email about this status change.

Is there an administrative account with Marketplace that will show all alerts and actions needed?

This is an enhancement that will be available in the near future.

How do I enter a claim?

Upon initial completion of the application, Orchid will run a loss history report. If you need to review the claims received from that report, or if you need to add claims, please revisit the Application page. On the first page, “Agent Questions”, you will then see a section for Claims. Those claims received from our loss history vendor will be displayed. You will also have the opportunity to add additional claims. If you see any information that does not seem accurate, please call underwriting to review and adjust, if needed.